Seafloor Acoustic Mapping Technologies in 2025: Transforming Ocean Exploration and Industry with Advanced Sonar and AI. Discover how cutting-edge innovations are reshaping marine data collection and unlocking new opportunities beneath the waves.

- Executive Summary: Key Trends and Market Outlook (2025–2030)

- Market Size, Growth Forecasts, and Investment Landscape

- Core Technologies: Multibeam, Sidescan, and Synthetic Aperture Sonar

- AI, Machine Learning, and Data Analytics in Seafloor Mapping

- Autonomous Underwater Vehicles (AUVs) and Remote Sensing Platforms

- Major Industry Players and Recent Innovations

- Applications: Energy, Environmental Monitoring, Defense, and Research

- Regulatory Frameworks and International Standards

- Challenges: Data Quality, Deepwater Mapping, and Environmental Impact

- Future Outlook: Emerging Technologies and Strategic Opportunities

- Sources & References

Executive Summary: Key Trends and Market Outlook (2025–2030)

Seafloor acoustic mapping technologies are entering a period of accelerated innovation and deployment, driven by expanding demands in offshore energy, marine infrastructure, environmental monitoring, and oceanographic research. As of 2025, the sector is characterized by rapid advancements in multibeam echosounders, synthetic aperture sonar, and autonomous survey platforms, with a strong emphasis on data resolution, operational efficiency, and integration with digital workflows.

Key industry players such as Kongsberg Maritime, Teledyne Marine, and Sonardyne International are at the forefront, introducing next-generation systems that offer higher swath coverage, improved depth penetration, and real-time data processing. For example, Kongsberg Maritime’s EM series multibeam echosounders are widely adopted for their reliability and high-resolution capabilities, while Teledyne Marine continues to expand its portfolio with advanced side-scan and synthetic aperture sonar solutions.

A significant trend for 2025 and beyond is the integration of acoustic mapping systems with autonomous and remotely operated vehicles (AUVs and ROVs). This shift is enabling persistent, cost-effective, and high-precision mapping in deepwater and hazardous environments. Companies like Fugro are deploying fleets of uncrewed surface vessels (USVs) equipped with advanced sonar payloads, supporting large-scale hydrographic surveys and subsea asset inspections with reduced carbon footprints.

The market outlook for 2025–2030 anticipates robust growth, underpinned by international initiatives such as the United Nations Decade of Ocean Science for Sustainable Development and the Seabed 2030 project, which aim to map the entire ocean floor by 2030. These efforts are catalyzing public-private partnerships and driving investment in scalable, interoperable mapping solutions. Industry bodies like the International Hydrographic Organization are also promoting standards for data quality and interoperability, further supporting market expansion.

Looking ahead, the sector is expected to see continued convergence of acoustic mapping with cloud-based analytics, artificial intelligence, and real-time data sharing. This will enable faster decision-making and broader accessibility of seafloor data for stakeholders in energy, defense, fisheries, and environmental management. As technology matures and costs decrease, adoption is projected to accelerate, particularly in emerging markets and for applications such as offshore wind, deep-sea mining, and marine spatial planning.

Market Size, Growth Forecasts, and Investment Landscape

The global market for seafloor acoustic mapping technologies is poised for robust growth through 2025 and the following years, driven by expanding applications in offshore energy, marine infrastructure, environmental monitoring, and national security. The sector encompasses a range of technologies, including multibeam and single-beam echo sounders, side-scan sonar, sub-bottom profilers, and advanced data processing software. These systems are essential for detailed bathymetric surveys, habitat mapping, pipeline and cable route planning, and unexploded ordnance detection.

Key industry players such as Kongsberg Maritime, Teledyne Marine, and Sonardyne International are at the forefront, offering integrated solutions that combine hardware, software, and autonomous platforms. Kongsberg Maritime continues to expand its multibeam echo sounder portfolio, supporting both deepwater and shallow-water applications, while Teledyne Marine leverages its broad sensor suite and autonomous vehicle integration to address diverse market needs. Sonardyne International specializes in subsea positioning and navigation, with a growing focus on data fusion and real-time mapping.

The market is experiencing increased investment from both public and private sectors. Government initiatives, such as the United Nations Decade of Ocean Science for Sustainable Development (2021–2030), are catalyzing funding for large-scale seafloor mapping projects. National hydrographic offices and organizations like GEBCO (General Bathymetric Chart of the Oceans) are collaborating with industry to accelerate the mapping of the world’s oceans, aiming for comprehensive coverage by 2030. This is stimulating demand for high-resolution, efficient mapping systems and driving innovation in autonomous and remotely operated survey platforms.

In 2025, the market is characterized by a shift toward higher-frequency, higher-resolution systems, and the integration of artificial intelligence for automated data processing. The adoption of uncrewed surface vessels (USVs) and autonomous underwater vehicles (AUVs) equipped with advanced acoustic sensors is expected to increase, reducing operational costs and enabling persistent, wide-area surveys. Companies such as Fugro are investing in remote and autonomous survey capabilities, reflecting a broader industry trend toward digitalization and automation.

Looking ahead, the seafloor acoustic mapping market is projected to maintain a strong growth trajectory, underpinned by ongoing investments in offshore wind, subsea telecommunications, and marine mineral exploration. Strategic partnerships between technology providers, survey operators, and government agencies will likely accelerate innovation and market expansion through the remainder of the decade.

Core Technologies: Multibeam, Sidescan, and Synthetic Aperture Sonar

Seafloor acoustic mapping technologies have advanced rapidly, with multibeam echosounders (MBES), sidescan sonar, and synthetic aperture sonar (SAS) forming the core suite of tools for high-resolution seabed characterization. As of 2025, these technologies are being deployed globally for applications ranging from hydrographic surveying and offshore infrastructure development to marine habitat mapping and deep-sea exploration.

Multibeam echosounders remain the industry standard for bathymetric mapping, offering wide swath coverage and precise depth measurements. Leading manufacturers such as Kongsberg Maritime and Teledyne Marine have introduced new MBES models with enhanced frequency agility, real-time data processing, and improved motion compensation. These systems now routinely achieve centimeter-scale vertical accuracy, even in challenging deepwater environments. The integration of MBES with positioning and motion reference units has enabled near-seamless mapping from shallow coastal zones to abyssal plains, supporting initiatives like the Seabed 2030 project.

Sidescan sonar continues to be indispensable for detailed imaging of seafloor features, wrecks, and anthropogenic objects. Recent systems from EdgeTech and Sonardyne offer dual-frequency operation, allowing operators to switch between wide-area reconnaissance and high-resolution target identification. Advances in towfish design and autonomous deployment platforms have expanded operational flexibility, enabling longer missions and coverage of previously inaccessible areas. Sidescan data is increasingly fused with MBES bathymetry to produce comprehensive seafloor mosaics.

Synthetic aperture sonar represents the cutting edge of acoustic imaging, delivering sub-decimeter resolution over swath widths previously unattainable with conventional sonar. Companies such as Kraken Robotics and Hydroid (a subsidiary of Huntington Ingalls Industries) have commercialized SAS systems that are now being adopted for military mine countermeasures, pipeline inspection, and scientific research. SAS leverages advanced signal processing and platform navigation to synthesize long virtual arrays, dramatically improving image clarity and detection capability.

Looking ahead, the next few years are expected to see further miniaturization, increased autonomy, and real-time onboard processing across all three core technologies. The proliferation of uncrewed surface and underwater vehicles will drive demand for compact, power-efficient sonar payloads. Enhanced data analytics and machine learning will accelerate the interpretation of acoustic datasets, supporting faster decision-making in both commercial and scientific domains. As these technologies mature, the vision of a fully mapped, dynamically monitored seafloor is becoming increasingly attainable.

AI, Machine Learning, and Data Analytics in Seafloor Mapping

The integration of artificial intelligence (AI), machine learning (ML), and advanced data analytics is rapidly transforming seafloor acoustic mapping technologies as of 2025. Traditionally, seafloor mapping relied on multibeam and side-scan sonar systems, generating vast datasets that required extensive manual interpretation. Today, the sector is witnessing a paradigm shift as AI and ML algorithms automate data processing, enhance feature detection, and improve the accuracy of seafloor characterization.

Leading manufacturers such as Kongsberg Maritime and Teledyne Marine are embedding AI-driven analytics into their sonar platforms. These systems now leverage deep learning models to automatically classify seabed types, detect anomalies, and identify objects of interest, significantly reducing the time from data acquisition to actionable insights. For example, Kongsberg’s latest multibeam echosounders are equipped with onboard processing units capable of real-time AI-based seabed classification, streamlining workflows for hydrographic surveyors and marine researchers.

The volume and complexity of acoustic data have also prompted the adoption of cloud-based analytics and collaborative platforms. Fugro, a global leader in geo-data solutions, has developed cloud-enabled data management systems that utilize ML algorithms for automated feature extraction and quality control. These platforms facilitate remote collaboration, allowing experts worldwide to access, analyze, and interpret seafloor data in near real-time, which is particularly valuable for large-scale projects such as offshore wind farm site assessments and subsea cable route planning.

Industry bodies like the International Hydrographic Organization (IHO) are actively promoting the standardization of AI and ML methodologies in hydrographic data processing. The IHO’s S-100 framework, for instance, is being updated to accommodate new data types and analytics workflows, ensuring interoperability and data integrity as AI adoption accelerates.

Looking ahead to the next few years, the outlook for AI and ML in seafloor acoustic mapping is robust. Ongoing advancements in edge computing are expected to further enable real-time onboard data analytics, reducing the need for post-mission processing. Additionally, the increasing availability of open training datasets and collaborative AI development initiatives will likely drive innovation, making high-resolution, automated seafloor mapping more accessible and cost-effective for a broader range of stakeholders.

Autonomous Underwater Vehicles (AUVs) and Remote Sensing Platforms

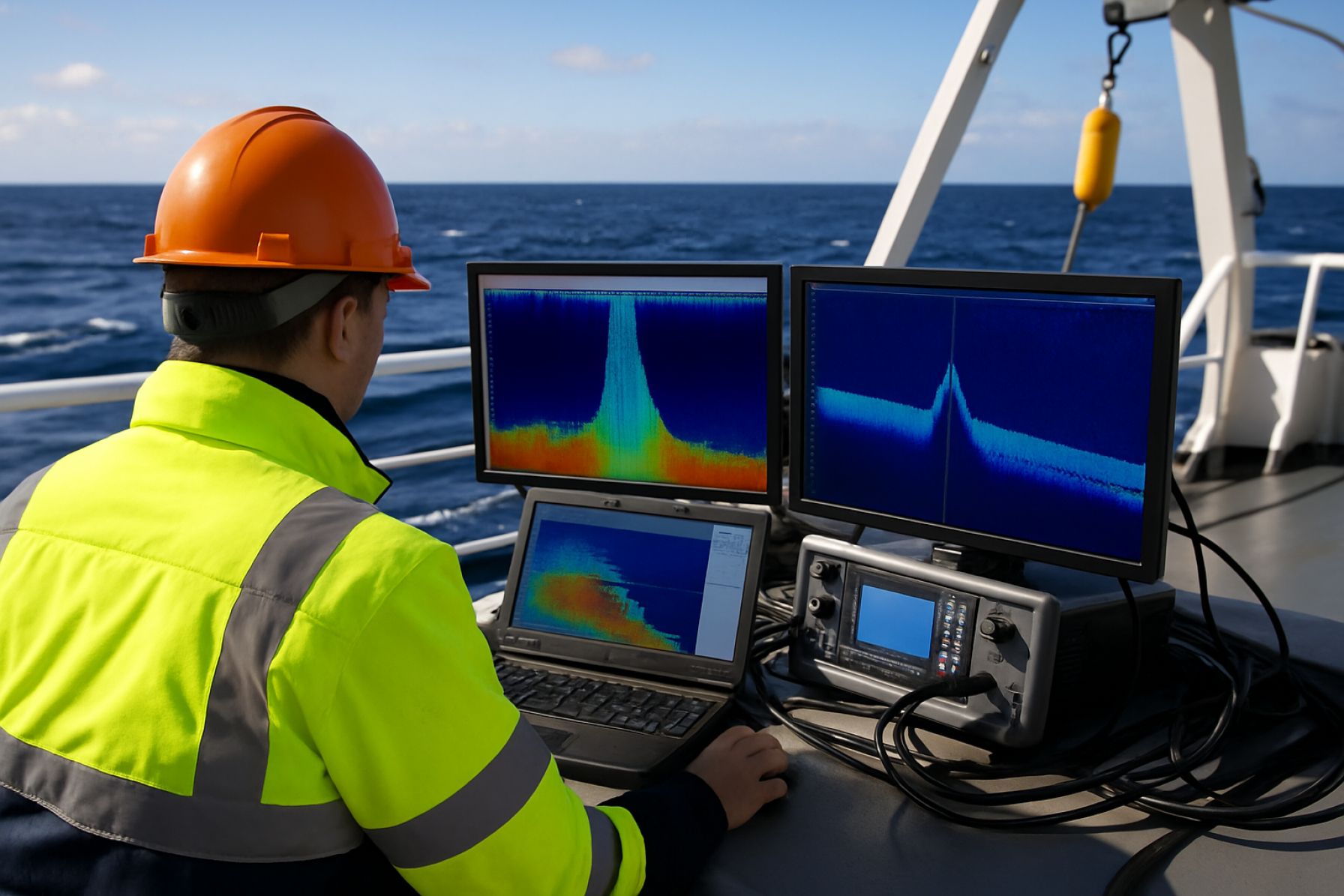

Autonomous Underwater Vehicles (AUVs) and remote sensing platforms are at the forefront of seafloor acoustic mapping technologies in 2025, driving a new era of high-resolution, efficient, and cost-effective ocean floor surveys. These platforms are equipped with advanced sonar systems—primarily multibeam and side-scan sonars—that generate detailed bathymetric and backscatter data, essential for applications ranging from marine resource management to subsea infrastructure planning.

AUVs have become increasingly sophisticated, with leading manufacturers such as Kongsberg Maritime and Teledyne Marine integrating high-frequency multibeam echo sounders, synthetic aperture sonars, and real-time data processing capabilities. The Kongsberg Maritime HUGIN series, for example, is widely deployed for deep-sea mapping, offering swath widths up to several hundred meters and depth ratings exceeding 6,000 meters. These AUVs can operate autonomously for over 24 hours, collecting gigabytes of acoustic data per mission.

Remote sensing platforms, including unmanned surface vehicles (USVs) and hybrid remotely operated vehicles (ROVs), are also gaining traction. Companies like Fugro are pioneering the use of USVs equipped with advanced acoustic payloads for shallow-water and nearshore mapping, reducing operational costs and environmental impact. Fugro’s Blue Essence USV, for instance, is designed for long-endurance missions and can be remotely operated from shore, enabling persistent data collection in challenging environments.

Recent years have seen a push towards real-time data transmission and cloud-based processing. Sonardyne International and Kongsberg Maritime are developing acoustic modems and underwater positioning systems that allow AUVs to relay mapping data to surface vessels or shore stations during missions, accelerating decision-making and reducing turnaround times.

Looking ahead, the outlook for seafloor acoustic mapping technologies is marked by further automation, increased data resolution, and integration with artificial intelligence for onboard data analysis. The International Hydrographic Organization’s Seabed 2030 initiative continues to drive demand for comprehensive mapping, with industry leaders like Kongsberg Maritime, Teledyne Marine, and Fugro expected to play pivotal roles in expanding global seafloor coverage over the next few years.

Major Industry Players and Recent Innovations

The seafloor acoustic mapping sector is experiencing rapid technological advancement, driven by the need for high-resolution, efficient, and cost-effective ocean floor surveys. As of 2025, several major industry players are at the forefront, introducing innovations that are reshaping the capabilities and applications of acoustic mapping systems.

A leading force in this domain is Kongsberg Maritime, renowned for its multibeam echo sounders and integrated mapping solutions. In recent years, Kongsberg has advanced its EM series, focusing on increased swath coverage, improved data accuracy, and real-time processing. Their systems are widely adopted for hydrographic, geophysical, and environmental surveys, and the company is actively integrating artificial intelligence for automated feature detection and data quality control.

Another key player, Teledyne Marine, continues to expand its portfolio of acoustic mapping products, including the Reson SeaBat multibeam sonars and BlueView imaging sonars. Teledyne’s recent innovations emphasize modularity and compactness, enabling deployment on autonomous underwater vehicles (AUVs) and uncrewed surface vessels (USVs). This trend is expected to accelerate through 2025 and beyond, as demand grows for remote and persistent seafloor mapping in challenging environments.

Sonardyne International is also making significant strides, particularly in the integration of acoustic positioning and mapping technologies. Their SPRINT-Nav and Solstice sonar systems are being adopted for high-resolution mapping and navigation, especially in deepwater and complex subsea terrains. Sonardyne’s focus on interoperability and data fusion is enabling more comprehensive and efficient survey operations.

In parallel, EdgeTech is recognized for its side scan sonar and sub-bottom profiling systems, which are widely used in marine archaeology, pipeline inspection, and habitat mapping. EdgeTech’s recent developments include higher frequency systems for ultra-high-resolution imaging and the integration of real-time data streaming for rapid decision-making.

Looking ahead, the industry is witnessing a shift toward greater automation, with companies like Kongsberg Maritime and Teledyne Marine investing in AI-driven data processing and cloud-based analytics. The adoption of AUVs and USVs equipped with advanced acoustic sensors is expected to expand, reducing operational costs and increasing survey coverage. Additionally, collaborations between technology providers and research institutions are fostering the development of next-generation mapping systems capable of deeper, faster, and more detailed seafloor exploration.

- Key players: Kongsberg Maritime, Teledyne Marine, Sonardyne International, EdgeTech

- Recent innovations: AI integration, modular sonar systems, real-time data streaming, and enhanced AUV/USV compatibility

- Outlook: Continued automation, deeper and higher-resolution mapping, and expanded use of autonomous platforms through 2025 and beyond

Applications: Energy, Environmental Monitoring, Defense, and Research

Seafloor acoustic mapping technologies are playing an increasingly pivotal role across energy, environmental monitoring, defense, and scientific research sectors in 2025, with rapid advancements expected in the near future. These technologies, primarily based on multibeam and sidescan sonar systems, are enabling higher-resolution, faster, and more cost-effective mapping of the ocean floor, which is critical for a range of applications.

In the energy sector, offshore oil, gas, and renewable energy developers rely on detailed seafloor maps for site selection, infrastructure placement, and risk assessment. Companies such as Kongsberg Maritime and Teledyne Marine are at the forefront, supplying advanced multibeam echosounders and integrated survey solutions. These systems are now being deployed on autonomous surface and underwater vehicles, allowing for continuous, high-resolution mapping even in challenging environments. The integration of real-time data processing and AI-driven interpretation is reducing survey times and improving safety for offshore operations.

Environmental monitoring is another area where acoustic mapping is indispensable. Detailed bathymetric and habitat maps support marine protected area management, biodiversity assessments, and monitoring of anthropogenic impacts such as trawling or subsea mining. Organizations like Fugro are leveraging their fleets of uncrewed surface vessels equipped with state-of-the-art sonar to deliver large-scale, high-density seafloor data for environmental agencies and research institutions. The trend toward open data sharing, exemplified by initiatives like The Nippon Foundation-GEBCO Seabed 2030 Project, is expected to accelerate, with more public-private partnerships and collaborative mapping campaigns.

In defense, seafloor mapping technologies are critical for mine countermeasures, submarine navigation, and undersea infrastructure security. Defense contractors and navies are investing in next-generation synthetic aperture sonar and high-frequency multibeam systems for improved detection and classification of objects on or near the seabed. Companies such as Sonardyne International are developing advanced acoustic positioning and imaging solutions tailored for military applications, including integration with autonomous underwater vehicles (AUVs) for covert and persistent operations.

Scientific research continues to benefit from the democratization and miniaturization of acoustic mapping tools. Academic institutions and oceanographic organizations are increasingly able to deploy compact, high-resolution sonar systems on smaller vessels and AUVs, expanding the scope of marine geology, biology, and archaeology studies. The next few years are expected to see further improvements in data fusion, cloud-based processing, and machine learning-driven feature extraction, making seafloor mapping more accessible and actionable across all sectors.

Regulatory Frameworks and International Standards

The regulatory landscape for seafloor acoustic mapping technologies is evolving rapidly as governments and international bodies recognize the strategic, environmental, and economic significance of detailed seafloor data. In 2025, the sector is shaped by a combination of national maritime laws, international conventions, and technical standards that govern both the deployment of mapping equipment and the management of collected data.

A central pillar is the United Nations Convention on the Law of the Sea (UNCLOS), which establishes the legal framework for marine scientific research, including the use of acoustic mapping technologies within Exclusive Economic Zones (EEZs) and international waters. UNCLOS mandates that states must grant consent for research in their EEZs, and this requirement is increasingly enforced as nations seek to protect sensitive marine environments and resources.

Technical standards for acoustic mapping are primarily set by organizations such as the International Hydrographic Organization (International Hydrographic Organization), which issues the S-44 Standards for Hydrographic Surveys. The S-44 document, updated periodically, defines minimum requirements for survey accuracy, data resolution, and metadata, directly influencing the design and operation of multibeam echosounders, side-scan sonars, and related systems. Compliance with these standards is essential for data to be accepted in official nautical charting and marine spatial planning.

In 2025, regulatory attention is also focused on the environmental impacts of acoustic mapping. The International Maritime Organization (International Maritime Organization) and regional bodies are reviewing guidelines to mitigate the effects of underwater noise on marine life, particularly from high-powered sonar systems. This is prompting manufacturers such as Kongsberg Maritime and Teledyne Marine—both global leaders in acoustic mapping hardware—to develop systems with adaptive power management and frequency modulation to minimize ecological disturbance.

Data governance is another area of regulatory development. The push for open-access seafloor data, exemplified by initiatives like The Nippon Foundation-GEBCO Seabed 2030 Project, is balanced by national security and commercial confidentiality concerns. As a result, countries are updating their data sharing protocols and licensing frameworks, often requiring that sensitive bathymetric data collected by private operators be submitted to national hydrographic offices for review and possible restriction.

Looking ahead, the next few years will likely see further harmonization of standards, especially as autonomous and remotely operated mapping platforms become more prevalent. Industry stakeholders, including equipment suppliers, survey companies, and regulatory agencies, are collaborating to ensure that new technologies remain compliant with evolving international norms, while also supporting sustainable ocean exploration and resource management.

Challenges: Data Quality, Deepwater Mapping, and Environmental Impact

Seafloor acoustic mapping technologies have advanced rapidly, yet several persistent challenges remain as the sector moves through 2025 and into the coming years. Three critical areas—data quality, deepwater mapping, and environmental impact—are at the forefront of industry focus, shaping both technological development and operational protocols.

Data Quality: High-resolution, accurate seafloor maps are essential for applications ranging from offshore energy to marine conservation. However, data quality is often compromised by factors such as water column variability, vessel motion, and equipment limitations. Leading manufacturers like Kongsberg Maritime and Teledyne Marine have introduced advanced multibeam echosounders and real-time motion compensation systems to address these issues. Despite these improvements, challenges persist in standardizing data processing and ensuring interoperability between different systems, especially as mapping projects increasingly rely on data integration from multiple platforms, including autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs).

Deepwater Mapping: Mapping the deep ocean remains a formidable technical and logistical challenge. The vastness and inaccessibility of deep-sea environments require robust, high-power acoustic systems capable of operating at extreme depths. Companies such as Sonardyne International and EdgeTech are developing deepwater-capable sonar systems and long-endurance AUVs to extend mapping capabilities beyond the continental shelf. However, the cost and complexity of deepwater operations, including the need for specialized vessels and support infrastructure, continue to limit the frequency and coverage of such missions. The industry outlook for 2025 and beyond includes increased collaboration through initiatives like the Seabed 2030 project, which aims to map the entire ocean floor by the end of the decade, leveraging both commercial and governmental resources.

Environmental Impact: The use of high-intensity acoustic sources has raised concerns about potential impacts on marine life, particularly marine mammals sensitive to sound. Regulatory scrutiny is increasing, with agencies in the US, EU, and Asia-Pacific requiring environmental assessments and mitigation measures for large-scale mapping projects. Manufacturers are responding by developing lower-impact sonar technologies and adaptive signal processing to minimize disturbance. For example, Kongsberg Maritime and Teledyne Marine are investing in research to reduce acoustic footprints and improve real-time monitoring of environmental effects.

Looking ahead, the sector is expected to balance the demand for higher-resolution, deeper, and more comprehensive seafloor data with the imperative to minimize environmental impact and ensure data integrity. Ongoing innovation, regulatory evolution, and international collaboration will be key drivers shaping the future of seafloor acoustic mapping technologies.

Future Outlook: Emerging Technologies and Strategic Opportunities

Seafloor acoustic mapping technologies are poised for significant advancements in 2025 and the coming years, driven by the convergence of high-resolution sonar systems, autonomous platforms, and data analytics. The global push for comprehensive ocean mapping—exemplified by initiatives such as Seabed 2030—continues to accelerate innovation and strategic investment in this sector.

A key trend is the rapid evolution of multibeam echosounder (MBES) systems, which are becoming more compact, energy-efficient, and capable of delivering finer spatial resolution. Leading manufacturers such as Kongsberg Maritime and Teledyne Marine are introducing next-generation MBES units with enhanced swath coverage and real-time data processing, enabling faster and more accurate mapping of complex seafloor topographies. These systems are increasingly integrated with motion sensors and positioning technologies to minimize data artifacts and improve georeferencing accuracy.

Another transformative development is the integration of acoustic mapping payloads onto autonomous underwater vehicles (AUVs) and uncrewed surface vessels (USVs). Companies like Hydroid (a subsidiary of Kongsberg) and Fugro are deploying fleets of AUVs and USVs equipped with advanced sonar arrays, allowing for persistent, cost-effective, and high-resolution mapping in remote or hazardous areas. This shift toward autonomy is expected to reduce operational costs and expand the reach of mapping campaigns, particularly in deep-sea and polar regions.

Data management and processing are also undergoing transformation. The adoption of cloud-based platforms and artificial intelligence (AI) is streamlining the conversion of raw acoustic data into actionable seafloor maps. Fugro and Kongsberg Maritime are investing in digital solutions that automate data cleaning, feature extraction, and quality control, significantly reducing turnaround times for end-users in sectors such as offshore energy, telecommunications, and marine research.

Looking ahead, the strategic opportunities in seafloor acoustic mapping will be shaped by the demand for environmental monitoring, offshore infrastructure development, and marine spatial planning. The ongoing miniaturization of sonar systems, coupled with advances in battery technology and AI-driven analytics, is expected to further democratize access to high-quality seafloor data. As regulatory frameworks increasingly mandate detailed seabed surveys for sustainable ocean use, the sector is likely to see continued growth and technological differentiation among key players such as Kongsberg Maritime, Teledyne Marine, and Fugro.

Sources & References

- Kongsberg Maritime

- Teledyne Marine

- Fugro

- International Hydrographic Organization

- GEBCO

- EdgeTech

- Kraken Robotics

- International Hydrographic Organization

- International Maritime Organization

- Kongsberg Maritime

- Teledyne Marine