Table of Contents

- Executive Summary & Key Findings: 2025 Outlook

- Market Size & Growth Forecasts Through 2030

- Latest Technological Breakthroughs in Cryogenic Fluorescence Microscopy

- Competitive Landscape: Leading Manufacturers & Innovators

- Key Applications in Research & Industry

- Regulatory Environment and Industry Standards

- Drivers, Challenges, and Barriers to Adoption

- Regional Analysis: North America, Europe, Asia-Pacific, and Beyond

- Strategic Partnerships, Collaborations, and M&A Activity

- Future Trends and Opportunities: What’s Next for Cryogenic Fluorescence Microscopy?

- Sources & References

Executive Summary & Key Findings: 2025 Outlook

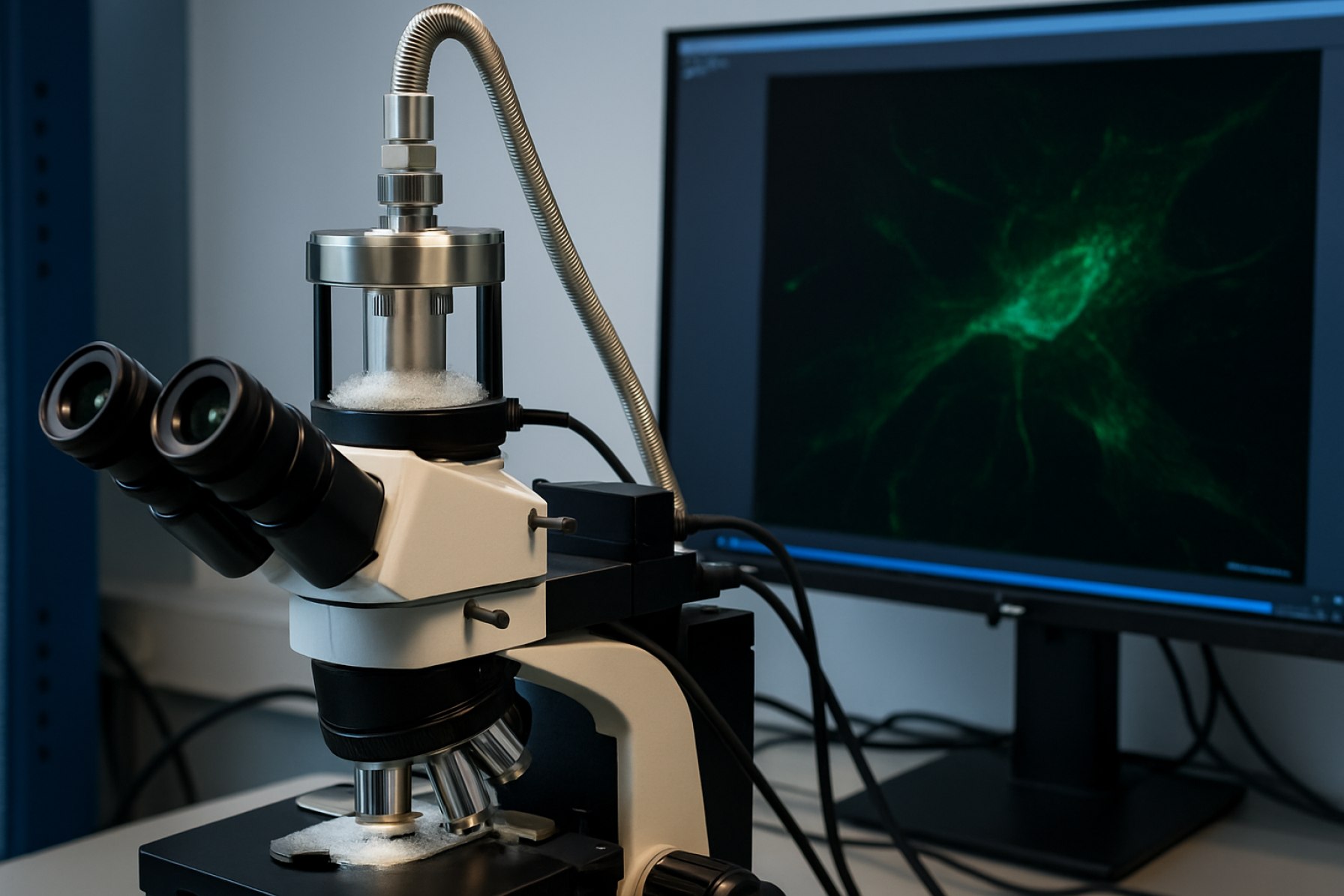

Cryogenic fluorescence microscopy systems are at the forefront of high-resolution biological imaging, enabling researchers to visualize molecular structures at near-native states with enhanced photostability. As of 2025, this sector is witnessing rapid technological advancement, driven by the need for greater spatial resolution and the integration of cryogenic workflows with correlative techniques.

A key trend in 2025 is the increasing adoption of cryogenic sample environments for super-resolution fluorescence microscopy. Companies such as Leica Microsystems and Carl Zeiss Microscopy have expanded their product portfolios to include turnkey systems and accessories that enable seamless transition between room temperature and cryogenic imaging. These solutions are optimized for compatibility with single-molecule localization microscopy (SMLM) techniques, where reduced thermal motion at cryogenic temperatures significantly enhances localization precision.

The integration of cryogenic fluorescence microscopy with cryo-electron microscopy (cryo-EM) is another pivotal development. Manufacturers such as Thermo Fisher Scientific and JEOL Ltd. are offering systems and workflows designed for correlative light and electron microscopy (CLEM) at cryogenic temperatures. This enables researchers to correlate functional fluorescence signals with ultrastructural details, streamlining the process of targeting specific regions of interest for high-resolution EM analysis.

Cryostage innovation is also accelerating, with companies like Linkam Scientific Instruments providing advanced temperature control systems that maintain sample integrity and reduce ice contamination. This is critical for live-cell cryo-imaging and for minimizing photodamage during extended exposures. Recent product launches in 2024 and 2025 reflect a focus on user-friendly interfaces, automation, and integration with existing laboratory infrastructure.

Looking ahead, market demand is expected to remain strong, propelled by pharmaceutical, academic, and structural biology sectors. The ongoing refinement of fluorescent probes, together with improved camera sensitivity and software for automated image analysis, will further enhance adoption rates. Industry collaboration between microscope manufacturers, cryo-accessory developers, and research institutions is anticipated to yield more robust, standardized workflows in the coming years.

In summary, the outlook for cryogenic fluorescence microscopy systems in 2025 is characterized by accelerated innovation, growing integration with complementary imaging modalities, and expanding end-user adoption. These trends position the sector for steady growth and continued technological leadership within the advanced microscopy landscape.

Market Size & Growth Forecasts Through 2030

Cryogenic fluorescence microscopy systems are experiencing significant growth, driven by increasing demand for advanced imaging techniques in life sciences, structural biology, and materials research. With the ability to preserve biological specimens at liquid nitrogen temperatures (typically around -196°C), these systems enable super-resolution imaging while minimizing photobleaching and radiation damage, making them essential tools for high-precision applications such as single-molecule localization microscopy and correlative light and electron microscopy (CLEM).

As of 2025, the market for cryogenic fluorescence microscopy systems is expanding, propelled by investments from both academic institutions and pharmaceutical companies seeking to enhance their drug discovery and structural analysis capabilities. Leading manufacturers such as Leica Microsystems, Carl Zeiss AG, and Oxford Instruments have reported growing demand for their cryogenic solutions, including integrated cryo-stages, automated workflows, and compatibility with high-end detectors. For instance, Leica Microsystems offers dedicated cryo-fluorescence platforms designed for seamless integration with electron microscopy, while Carl Zeiss AG markets specialized cryo-imaging modules suitable for high-resolution and correlative workflows.

Recent industry data suggests that the global adoption of cryogenic fluorescence microscopy is accelerating, particularly in North America, Europe, and East Asia. The increase in structural biology research, fueled by initiatives such as the European Molecular Biology Laboratory (EMBL) and investments in next-generation drug development, is contributing to sustained market growth. The availability of turnkey cryo-imaging solutions and improvements in automation are lowering the technical barriers for new entrants, further broadening the customer base.

- Market Size (2025): While precise revenue figures are proprietary, leading suppliers report double-digit percentage growth in sales of cryogenic microscopy systems and accessories compared to previous years, driven by robust demand for single-molecule and CLEM applications (Oxford Instruments).

- Growth Projections (2025–2030): The market is expected to maintain a compound annual growth rate (CAGR) in the high single to low double digits through 2030. This growth will be fueled by expanding research applications, greater integration of artificial intelligence for automated image analysis, and increasing cross-discipline adoption in both academia and industry (Leica Microsystems).

Looking ahead, the outlook for cryogenic fluorescence microscopy systems remains robust. The next few years will likely see further advances in detector sensitivity, sample handling automation, and multi-modal imaging solutions. Key players anticipate expanding their product portfolios to address the evolving needs of the structural biology and pharmaceutical sectors, ensuring continued growth and innovation in this specialized market.

Latest Technological Breakthroughs in Cryogenic Fluorescence Microscopy

Cryogenic fluorescence microscopy (cryo-FM) has recently seen significant technological advances, positioning it as a pivotal tool for high-resolution biological imaging. The integration of cryogenic temperatures (typically below -130°C) with advanced fluorescence optics preserves delicate sample structures, minimizes photobleaching, and enables correlation with cryo-electron microscopy (cryo-EM). In 2025, manufacturers and research institutions are accelerating innovations in cryo-FM systems, focusing on automation, resolution, and workflow integration.

- Enhanced Workflow Automation and Integration: Companies like Leica Microsystems have introduced cryo-fluorescence platforms that streamline sample transfer between cryo-light and electron microscopes. Their EM Cryo CLEM system enables seamless correlative workflows, reducing sample contamination risk and enhancing throughput. This integrated approach is vital for multi-modal imaging, especially in cell biology and structural virology.

- Super-Resolution at Cryogenic Temperatures: Recent breakthroughs allow super-resolution techniques such as single-molecule localization microscopy (SMLM) to be performed under cryogenic conditions. Carl Zeiss Microscopy has expanded its Cryo-CLEM portfolio with advanced optics and cryo-stages, supporting high-precision localization at nanometer scales. Their solutions emphasize minimizing thermal drift, crucial for reliable long-term imaging.

- High-Throughput and Automation: Automation in sample handling and imaging is a priority for developers like Thermo Fisher Scientific. Their cryo-fluorescence microscopes now feature motorized stages and programmable workflows, supporting large-scale imaging campaigns and rapid identification of regions of interest for downstream cryo-EM.

- Optical and Mechanical Stability: Maintaining sample integrity at low temperatures is a core challenge. Linkam Scientific Instruments has optimized cryo-stages with precise temperature control and anti-contamination features, supporting extended imaging sessions and reproducible results.

Looking ahead, the field is moving toward further miniaturization and integration, with emerging systems combining cryo-FM, super-resolution modalities, and direct correlation with electron microscopy. Advances in detector sensitivity and objective lens technology are also expected to push spatial resolution beyond current limits, enabling new discoveries in cell biology and structural analyses. As leading equipment providers continue to refine cryogenic platforms, adoption is set to expand across academic and pharmaceutical sectors, particularly where high-resolution, artifact-free imaging is indispensable.

Competitive Landscape: Leading Manufacturers & Innovators

The competitive landscape for cryogenic fluorescence microscopy systems in 2025 is characterized by the involvement of a select group of specialized manufacturers and innovators who are pushing the boundaries of high-resolution imaging at ultra-low temperatures. The field remains highly specialized due to the technical challenges involved in combining cryogenic environments with advanced fluorescence detection, and is witnessing growing investment as demand for single-molecule and cryo-correlative imaging in structural biology and materials science intensifies.

Among the established leaders, Leica Microsystems continues to play a pivotal role with its EM Cryo CLEM platform, which enables correlative light and electron microscopy workflows at cryogenic temperatures, and integrates seamlessly with their super-resolution and confocal systems. Carl Zeiss Microscopy has maintained its market position with cryo-compatible solutions designed for multi-modal imaging, notably via their Airyscan and LSM platforms, and their ZEISS Cryo Workflow for CLEM applications. In parallel, Evident (formerly Olympus) has continued to support cryogenic imaging workflows through modular upgrades and accessories compatible with their flagship microscope lines.

Rapid innovation is also being driven by emerging players and collaborations. CryoImager, a US-based company, specializes in turnkey cryogenic fluorescence microscopy systems for both academic and industrial research, focusing on user-friendly operation and high sensitivity. Europe’s DELMIC offers the METEOR system, designed for high-throughput, fully-automated cryo-fluorescence imaging to support cryo-electron tomography sample preparation. Meanwhile, JENOPTIK contributes with cryo-compatible optical components and correlative microscopy solutions, expanding application flexibility.

In 2025 and beyond, the competitive landscape is expected to evolve through intensified R&D investment, particularly in automation, integration of artificial intelligence for image analysis, and improved user interfaces. Strategic partnerships between instrument manufacturers and research institutions are accelerating innovation, as seen in joint projects for developing next-generation cryo-imaging modalities. Furthermore, companies are responding to growing demand from the pharmaceutical and structural biology sectors for scalable, robust cryogenic fluorescence platforms to support drug discovery and advanced biomolecular research.

With the field poised for further growth, leading suppliers are focusing on facilitating seamless workflows between fluorescence and electron microscopy, improving sample preservation, and reducing barriers to entry for new adopters. The next few years will likely see an expansion of product portfolios, further lowering the technical threshold for high-end cryogenic fluorescence imaging, and broadening access to this powerful technology.

Key Applications in Research & Industry

Cryogenic fluorescence microscopy systems are rapidly advancing as essential tools in both scientific research and industrial workflows. By enabling high-resolution imaging at cryogenic temperatures, these systems significantly improve photostability and reduce sample degradation, making them invaluable for visualizing biological structures and molecular interactions at unprecedented detail. As of 2025, the adoption of cryogenic fluorescence microscopy is notably expanding across several key application areas.

-

Structural Biology and Protein Science:

Cryogenic fluorescence microscopy, especially when integrated with cryo-electron microscopy (cryo-EM), is revolutionizing the field of structural biology. The combination allows researchers to localize fluorescently labeled biomolecules within vitrified specimens, facilitating precise correlation between fluorescence signals and ultrastructural details. Companies like Leica Microsystems are offering platforms designed for correlative light and electron microscopy (CLEM) at cryogenic temperatures, supporting breakthroughs in mapping protein complexes and cellular architecture. -

Single-Molecule Localization and Super-Resolution Imaging:

Cryogenic conditions drastically limit photobleaching and blinking of fluorophores, enabling super-resolution techniques such as cryo-STORM and cryo-PALM. This is crucial for single-molecule studies and quantitative imaging of low-abundance targets. Abberior Instruments and Carl Zeiss Microscopy are advancing commercial systems that support these modalities, with applications in studying protein nanostructures and tracking molecular interactions in situ. -

Drug Discovery and Pharmaceutical Development:

Pharmaceutical research is leveraging cryogenic fluorescence microscopy to visualize drug-target interactions and assess compound efficacy at the molecular level. The enhanced resolution and preserved structural integrity at cryogenic temperatures allow for more accurate analysis of protein conformations and ligand binding, potentially accelerating lead optimization pipelines. Thermo Fisher Scientific provides integrated cryo-CLEM solutions tailored for drug discovery workflows. -

Materials Science and Nanotechnology:

Beyond life sciences, cryogenic fluorescence microscopy is gaining traction in materials research, enabling the study of nanomaterials, polymers, and hybrid systems at low temperatures. This approach reveals fluorescence properties and nanoscale organization that are often masked at ambient conditions. Linkam Scientific Instruments develops specialized cryo-stages that support such interdisciplinary applications.

Looking ahead, the next few years are expected to see further integration of cryogenic fluorescence microscopy with automation, AI-driven image analysis, and multi-modal imaging platforms. These advances will broaden its accessibility and impact across both academic and industrial sectors, supporting innovations in biomedical research, drug development, and advanced materials engineering.

Regulatory Environment and Industry Standards

The regulatory environment and industry standards for cryogenic fluorescence microscopy systems are evolving rapidly as these technologies are increasingly adopted for high-resolution imaging in structural biology, cell biology, and pharmaceutical research. As of 2025, regulatory oversight and standardization are driven by the dual imperatives of ensuring user safety and guaranteeing data reliability, while also fostering innovation in a field characterized by rapid technological advancement.

In the United States, the Food and Drug Administration (FDA) does not specifically regulate cryogenic fluorescence microscopes as standalone devices; however, systems intended for clinical diagnostic applications may fall under broader medical device regulations, particularly if used in conjunction with other diagnostic platforms. Manufacturers such as Carl Zeiss AG and Leica Microsystems comply with general quality management standards such as ISO 13485 for medical devices, ensuring that their cryogenic systems meet stringent manufacturing, safety, and traceability requirements.

The International Organization for Standardization (ISO) and the International Electrotechnical Commission (IEC) play a pivotal role in shaping industry standards. For instance, ISO 21073:2019, which covers cryogenic vessels, and IEC 61010-1, addressing general safety requirements for laboratory equipment, are frequently referenced by manufacturers in the design and validation of cryogenic fluorescence microscopy systems. Additionally, the push for data reproducibility and interoperability is reflected in the adoption of standards like the Open Microscopy Environment (OME) data model, supported by organizations such as the Open Microscopy Environment, which facilitates standardization in data formats and metadata reporting.

In the European Union, the transition to the Medical Device Regulation (MDR 2017/745), which became fully applicable in 2021, continues to influence how cryogenic fluorescence microscopy systems are classified and marketed, especially for clinical and in vitro diagnostic applications. Leading suppliers are aligning product documentation and risk assessment procedures to meet these evolving requirements, with companies like Thermo Fisher Scientific actively participating in industry working groups to anticipate regulatory changes.

Looking forward, stakeholders anticipate increased regulatory scrutiny of software and AI-based analysis modules integrated into cryogenic fluorescence microscopy platforms. The next few years are also likely to see greater emphasis on sustainability standards for cryogenic coolants and energy consumption, aligned with broader laboratory environmental goals. Ongoing collaboration between manufacturers, standards bodies, and regulatory agencies will be crucial in ensuring that innovation in cryogenic fluorescence microscopy progresses in tandem with robust safety and quality frameworks.

Drivers, Challenges, and Barriers to Adoption

Cryogenic fluorescence microscopy (cryo-FM) systems are gaining traction in the life sciences due to their unique ability to combine high-resolution fluorescence imaging with cryogenic sample preservation, enabling visualization of ultrastructural details at nanometer scales. Several drivers are propelling the adoption of these systems as we enter 2025.

- Drivers: A primary driver is the growing demand for correlative light and electron microscopy (CLEM), which leverages cryo-FM to localize fluorescently labeled biomolecules prior to cryo-electron microscopy. This workflow is critical for advancing structural cell biology, neurobiology, and virology. Major players such as Leica Microsystems and Carl Zeiss AG continue to develop integrated cryo-CLEM solutions, with recent systems like Leica’s Cryo CLEM corrals and Zeiss’s Cryo Workflow supporting streamlined, automated correlation between modalities. Additionally, the life science research community is increasingly focusing on the preservation of native cellular states, driving adoption of cryogenic techniques to minimize sample damage and photobleaching during imaging (Thermo Fisher Scientific).

- Challenges: However, technical and operational challenges remain significant. Cryogenic sample handling and transfer require specialized expertise and infrastructure, limiting widespread use outside dedicated core facilities. The integration of high-numerical-aperture objectives with cryogenic stages remains mechanically and optically demanding, and issues such as ice contamination or devitrification can compromise sample integrity. Companies like Linkam Scientific Instruments and Jenoptik AG are working to address these barriers with advanced cryo-stages and environmental controls, but the learning curve and maintenance needs persist.

- Barriers to Adoption: Cost remains a substantial barrier, as complete cryo-FM systems, including environmental chambers and integrated imaging platforms, typically represent a significant capital investment. Furthermore, the lack of standardized protocols and compatible consumables can hinder reproducibility and scalability, particularly for multi-user environments or high-throughput applications. While ongoing collaborations between instrument providers and leading research institutes aim to standardize workflows, as seen with European Bioinformatics Institute (EMBL-EBI) and major vendors, progress is gradual.

Looking ahead to the next few years, increased automation, user-friendly software, and broader educational initiatives are expected to alleviate some challenges, potentially democratizing access to cryogenic fluorescence microscopy. Yet, significant research and development will be required to reduce complexity and costs, ensuring that these advanced imaging systems can fulfill their promise across the broader life sciences landscape.

Regional Analysis: North America, Europe, Asia-Pacific, and Beyond

The regional landscape for cryogenic fluorescence microscopy systems is undergoing rapid evolution, shaped by research investments, infrastructure, and the presence of key manufacturers. North America continues to lead in both adoption and innovation, driven by active life sciences research communities and the presence of leading manufacturers. For example, Leica Microsystems and Carl Zeiss Microscopy, both with significant operations in the US and Europe, are expanding advanced cryogenic solutions for super-resolution imaging and correlative light and electron microscopy (CLEM) applications. Major research centers, such as the National Institutes of Health (NIH), continue to deploy these systems for structural biology and protein localization studies.

In Europe, the market is marked by a strong focus on collaborative research initiatives and infrastructure investments. The European Molecular Biology Laboratory (EMBL) and its imaging facilities exemplify the regional commitment to next-generation cryogenic fluorescence platforms. European support for open-access core facilities, such as those found in Germany and the UK, sustains demand for both commercial systems and custom-built cryogenic setups. Companies like Jenoptik and Oxford Instruments are also increasingly visible in this space, providing enabling technologies for low-temperature imaging.

The Asia-Pacific region is experiencing accelerated growth, attributed to rising investments in biotechnology, expanding academic research, and improving laboratory infrastructure. In Japan, universities and institutes are adopting advanced cryogenic fluorescence microscopes, supported by domestic innovation from leading optics manufacturers such as Olympus Life Science and Nikon Corporation. China is likewise investing in high-end microscopy systems through government-backed research funding and collaborations, with growing domestic manufacturing capacity to meet regional demand.

- North America: Market leadership driven by R&D; strong presence of global manufacturers and advanced user base.

- Europe: Emphasis on collaborative projects and open-access imaging facilities; robust ecosystem of suppliers and research users.

- Asia-Pacific: Fastest growth in adoption rates; significant expansions in academic and industrial research spending.

- Other Regions: Regions such as Latin America and the Middle East are in early adoption stages, with interest rising as research infrastructure develops.

Looking ahead to 2025 and beyond, continued regional investment in biological imaging, coupled with expanding partnerships between research institutions and manufacturers, is expected to drive further adoption of cryogenic fluorescence microscopy systems worldwide. Enhanced system integration, automation, and localized support offerings will likely shape competitive dynamics among leading players in each region.

Strategic Partnerships, Collaborations, and M&A Activity

Strategic partnerships, collaborations, and mergers & acquisitions (M&A) are shaping the evolving landscape of cryogenic fluorescence microscopy systems in 2025 and are expected to intensify in the coming years. The sector, driven by the demand for ultra-high-resolution imaging and integration with cryo-electron microscopy (cryo-EM), is witnessing increased cross-sector alliances among microscopy manufacturers, technology innovators, and leading academic institutions.

One notable trend is the collaboration between established microscopy companies and cryogenic sample preparation specialists. For instance, Leica Microsystems has partnered with several research institutions to advance cryo-correlative light and electron microscopy (cryo-CLEM), integrating their advanced fluorescence platforms with cryo-workflows. Similarly, Carl Zeiss AG continues to expand its ecosystem through technology-sharing agreements and joint development projects aimed at improving cryo-fluorescence imaging and automation, as evidenced by their ongoing integration of cryo-solutions with the ZEISS LSM and Crossbeam systems.

Meanwhile, biotech and life science tool companies are forging alliances to address the technical challenges of sample handling and workflow automation at cryogenic temperatures. Thermo Fisher Scientific, a leader in cryo-EM, has been actively collaborating with fluorescence microscopy and cryo-accessory developers to create more streamlined, end-to-end cryo-imaging solutions. These partnerships aim to close the gap between cryo-fluorescence microscopy and downstream structural analysis, a trend further reinforced by collaborations with academia such as the EMBL (European Molecular Biology Laboratory).

In terms of M&A activity, 2025 continues to see selective acquisitions targeting innovative startups and specialized technology providers. For example, Oxford Instruments has shown interest in expanding its cryo-imaging portfolio through the acquisition of niche cryo-accessory firms, aiming to strengthen its position in the emerging market for integrated cryogenic super-resolution systems. Such moves align with the industry’s focus on providing comprehensive, plug-and-play cryogenic workflows for advanced biological and materials research.

Looking ahead, the next few years are likely to bring further consolidation and deeper collaboration, particularly as the boundaries between fluorescence, electron, and X-ray microscopy continue to blur. Industry leaders are expected to pursue more joint ventures with software and automation specialists to deliver robust, user-friendly cryogenic imaging platforms. This collaborative momentum is anticipated to accelerate the adoption of cryogenic fluorescence microscopy in both academic and industrial research, supporting discoveries in cellular biology, drug development, and nanomaterials.

Future Trends and Opportunities: What’s Next for Cryogenic Fluorescence Microscopy?

Cryogenic fluorescence microscopy systems are poised for significant growth and innovation in 2025 and the coming years, driven by rapid advances in both cryogenic technology and fluorescence imaging. These hybrid platforms, which combine the molecular specificity of fluorescence with the ultrastructure preservation enabled by cryogenic temperatures, are increasingly critical for correlative light and electron microscopy (CLEM), single-molecule localization, and high-resolution structural biology.

A key trend is the integration of turnkey cryo-fluorescence modules with electron and ion microscopy workflows. Companies such as Leica Microsystems and Carl Zeiss have recently expanded systems that streamline the transition from cryogenic fluorescence to electron microscopy, enabling precise targeting of regions of interest and reducing sample loss. Moreover, Thermo Fisher Scientific continues to enhance its cryo-fluorescence solutions for seamless CLEM workflows, with automated sample transfer and improved image correlation software.

Technological improvements are also anticipated in the realm of detection sensitivity and spatial resolution. The adoption of sCMOS and hybrid detectors, together with new cryo-compatible objective lenses and immersion media, is enabling single-molecule detection at even lower temperatures. For instance, Andor Technology is advancing ultra-sensitive cameras tailored for low-light cryogenic applications, expected to become more widely adopted in the next few years.

Automation and ease-of-use are further future opportunities. Current systems require substantial expertise in cryogenics and sample handling, but next-generation platforms will likely feature enhanced automation in sample loading, temperature control, and data acquisition. Linkam Scientific Instruments is developing cryo stages with automated workflows and integrated environmental control, aiming to make cryogenic fluorescence microscopy more accessible to non-specialist laboratories.

Looking ahead, the field is set to benefit from increased collaboration with life science and pharmaceutical researchers, particularly in areas such as cell biology, virology, and drug discovery, where high-resolution, minimally invasive imaging is required. Systems will increasingly support high-throughput imaging and machine learning-based image analysis, driven by demands for quantitative, reproducible results. As more manufacturers invest in cryo-compatible super-resolution techniques, the coming years are likely to see broader adoption of cryogenic fluorescence microscopy, both as a stand-alone technology and as an integral part of multi-modal imaging pipelines.

Sources & References

- Leica Microsystems

- Carl Zeiss Microscopy

- Thermo Fisher Scientific

- JEOL Ltd.

- Oxford Instruments

- European Molecular Biology Laboratory (EMBL)

- Evident (formerly Olympus)

- DELMIC

- JENOPTIK

- Abberior Instruments

- Open Microscopy Environment

- Linkam Scientific Instruments

- European Bioinformatics Institute (EMBL-EBI)

- Nikon Corporation

- Andor Technology